Mortgage Rates Set Record Low for 10th Time

Mortgage rates fell slightly last week, setting a new record low for the 10th time this year, Freddie Mac reports. The 30-year fixed-rate mortgage averaged 2.81%, the lowest rate since Freddie Mac began tracking such data in 1971. The previous all-time low, an average of 2.86%, was set in mid-September.

“Low mortgage rates have become a regular occurrence in the current environment,” says Sam Khater, Freddie Mac’s chief economist. “As we hit yet another record low, many people are benefiting, as refinance activity remains strong. However, it’s important to remember that not all people are able to take advantage of low rates, given the effects of the pandemic.”

But homebuyers who are ready to enter the market are rushing to take advantage of lower borrowing costs. “With mortgage rates to remain near 3% for the next couple of years, homebuying activity is expected to stay strong for several more years,” Nadia Evangelou, a research economist for the National Association of REALTORS®, wrote on NAR’s Economists’ Outlook blog.

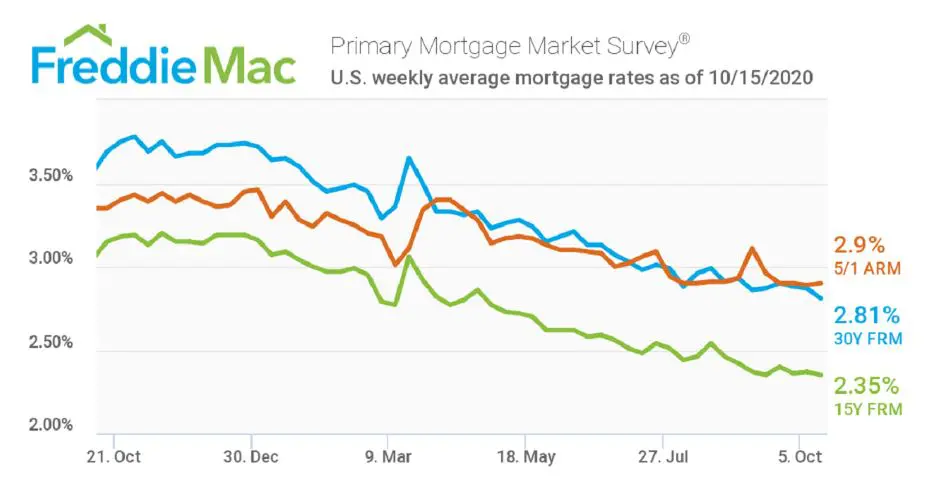

Freddie Mac reports the following national averages for the week ending Oct. 15:

30-year fixed-rate mortgages: averaged 2.81%, with an average 0.6 point, down from last week’s 2.87% average. Last year at this time, 30-year rates averaged 3.69%.

15-year fixed-rate mortgages: averaged 2.35%, with an average 0.5 point, falling from last week’s 2.37% average. A year ago, 15-year rates averaged 3.15%.

5-year hybrid adjustable-rate mortgages: averaged 2.90%, with an average 0.2 point, slightly falling from last week’s 2.89% average. A year ago, 5-year ARMs averaged 3.35%.

Freddie Mac reports average commitment rates, along with average points, to reflect the total upfront cost of obtaining a mortgage.

Source: REALTOR® Magazine