Study: Homeowner Wealth Is 40 Times Higher Than Renters

Most owners have earned more than $100,000 in equity over the last decade, but discrepancies among racial groups persists, according to new NAR data.

Property appreciation has surged along with home prices in the last decade, giving most homeowners more than $100,000 in equity over that time period and lending further evidence that homeownership is an important avenue to build household wealth.

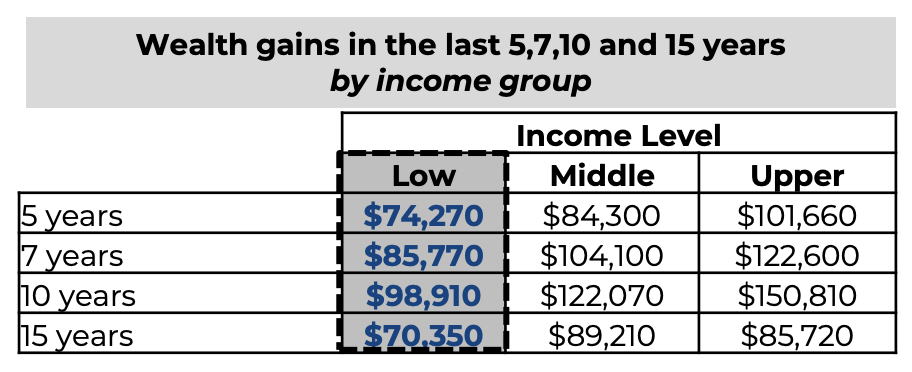

Middle-income homeowners have seen their properties appreciate by 68% since 2012, accumulating $122,100 in wealth, according to a new report from the National Association of REALTORS® released during the 2023 REALTOR® Broker Summit. Low-income homeowners who earn less than 80% of their area’s median income saw $98,900 in equity gains in the same time period, while upper-income households who earn more than 200% of their area’s median income accrued $150,800 in equity, according to NAR’s report, “Wealth Gains by Income and Racial/Ethnic Group.”

“This analysis shows how homeownership is a catalyst for building wealth for people from all walks of life,” says NAR Chief Economist Lawrence Yun. “A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than that of a renter.”

Along with these wealth gains, homeowners also saw their debt drop by 21% over the last decade, the report shows. In recent years, many homeowners were able to refinance their mortgages and secure an interest rate below 4%. And because of those smaller monthly payments, many homeowners have paid off an even larger amount of their mortgage, the report notes.

Equity Gains Are Not Equal

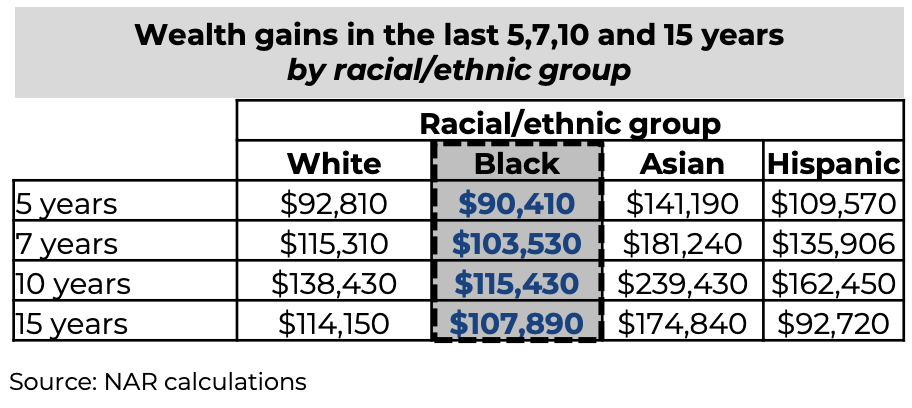

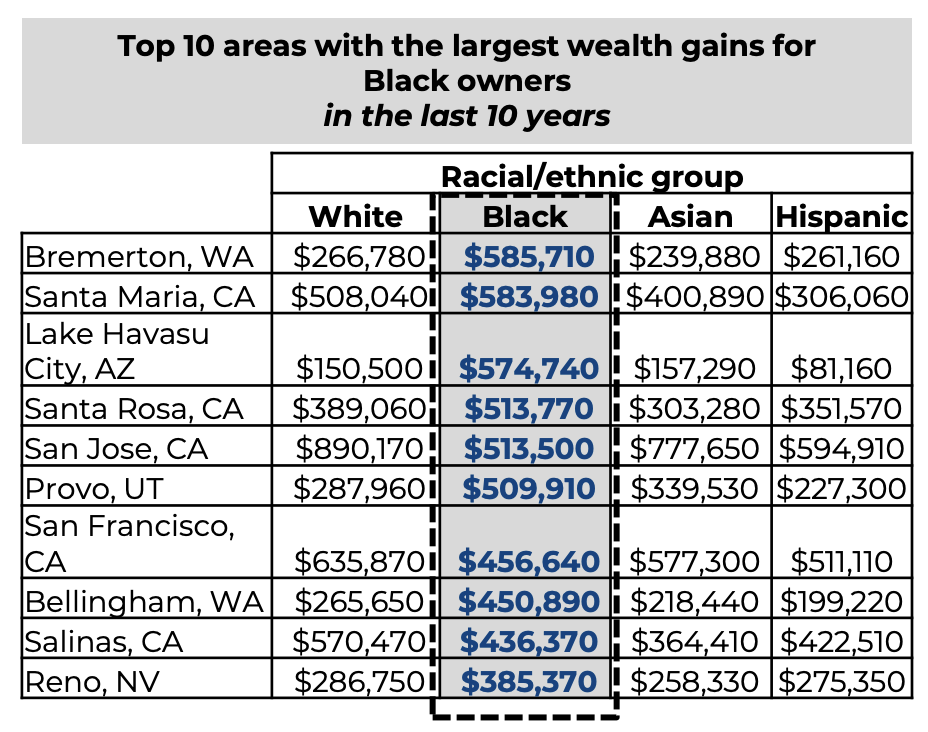

Still, NAR’s report reveals the roadblocks many Americans still face in obtaining the same opportunities for homeownership, calling out “substantial variations and inequalities in homeownership rates across different incomes and racial and ethnic groups.” Black homeowners accrued the smallest wealth gains over the last decade compared to any other racial or ethnic group, the report shows. Black homeownership rates also continue to lag behind.

“Data shows that significantly fewer low-income households and households of color own their home and are able to build wealth compared to other income and racial/ethnic groups,” NAR’s report states.

Largest Wealth Gains From Homeownership

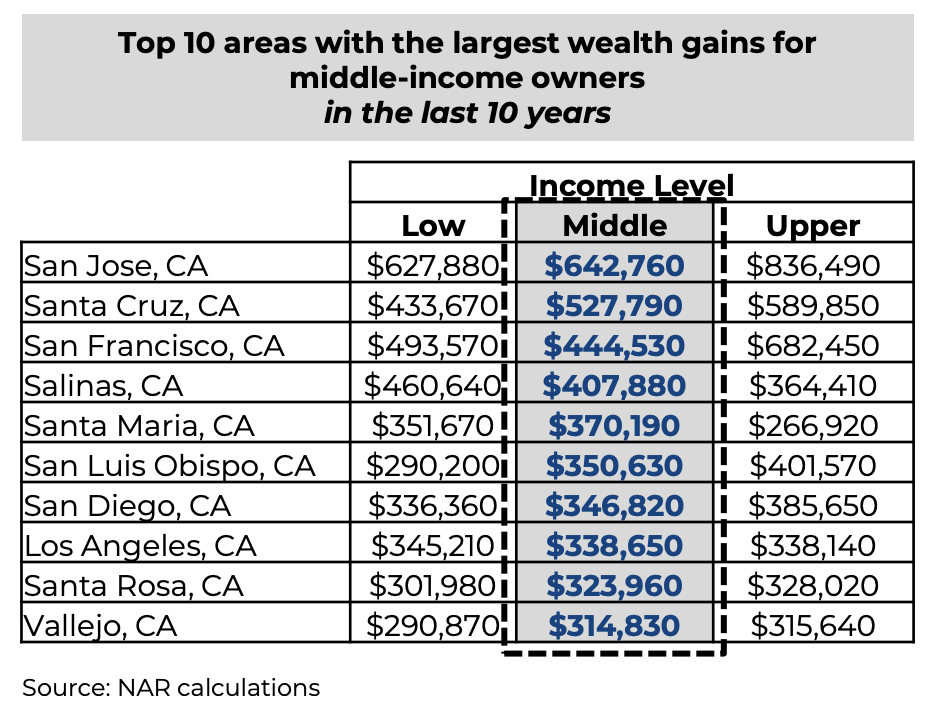

Owners who live in pricey metro areas have seen some of the largest wealth gains over the last decade, according to NAR’s report. For example, in the San Jose metro area, low-income earners have accumulated nearly $630,000 over the last 10 years while middle-income earners gained $643,000. All of the top 10 areas with the largest wealth gains for low-income owners—with equity surpassing $290,000—were located in California.

Source: REALTOR® Magazine